On 5 March 2021, Eric Yuan, the Founder and Chief Executive Officer of Zoom Video Communications Inc. (“Zoom”), a company listed on NASDAQ in USA, made the regulatory filing about his transfer of about 18 million shares (approximately 40%, valued at US$6 billion) of his shareholding in Zoom to two unspecified beneficiaries in accordance with Eric Yuan and his wife’s trust.

The family trust arrangement is commonly used for initial public offering (“IPO”) structure, and many controlling shareholders of a listing vehicle will establish a pre-IPO trust, which will facilitate the listing process and avoid instability after the IPO. Also, pre-IPO trust can be a mean for the company to award shares to the senior management of a company prior to IPO. The company can impose conditions for sales of shares to inline interests of the senior management with the company. Furthermore, under a trust scheme, the majority shareholders can decide whether to withhold management and to exercise all voting rights attaching to the shares under the pre-IPO trust.

The followings are majority benefits of using the pre-IPO trust structure:-

- Concentration of shareholding & voting rights: when the shares of the controlling shareholders are transferred to the trustee, the shares will be concentrated under the hand of the trustee, and will not be sub-divided to his successors owing to the death of the controlling shareholder. Furthermore, during the general meetings of the listed company, the voting rights of the controlling shareholder shall not be dispersed.

- Asset protection: since the legal title of the shares are registered under the trustee, the listed shares will be protected and shielded against any claims by the creditors, divorcing spouse of the controlling shareholder.

- Smooth listing process: as the listing will take time, the listing process will not be adversely affected by unexpected events and claims happening on the controlling shareholders.

- Stable Share price: the share price of the listed shares will be more stable and will not be affected by personal issues of controlling shareholders, such as health issues, death, mental incapacity, financial difficulties, etc.

- Confidentiality about beneficiaries: only the trustee and settlor will be reported to the Stock Exchange, whereas the identities of the beneficiaries will be confidential unless they are substantial shareholders, director or senior management of the listed company.

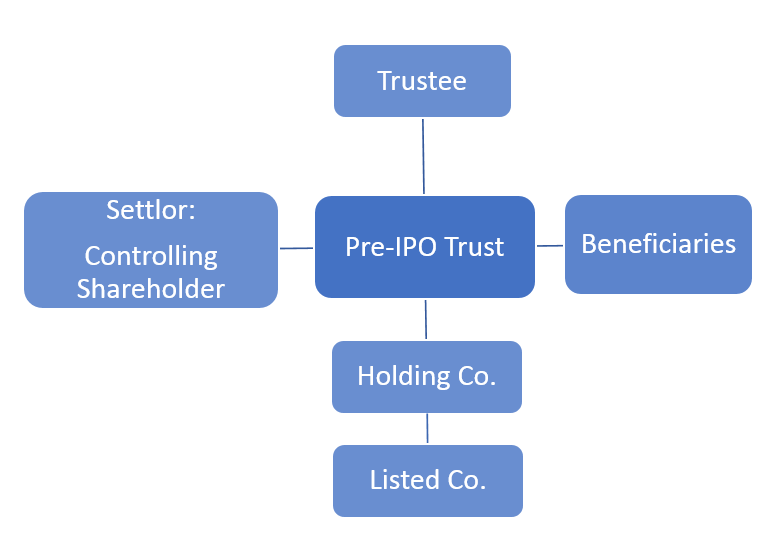

The following is the standard structure for pre-IPO trust. Please feel free to contact us at enquiry@hksunlawyers.com for further enquiries.